Deadline for filing Form W-2 is January 31, 2024. E-file W-2 Now

Benefits of E-Filing Form W-2 with our Software

Supports Form W-2 State Filing

TIN Matching for

Form W-2

Form W-2 Bulk Upload

Postal Mailing W-2 Copies

Online Access Portal

EFW2 File Upload

Multi-User Access

US-based Support

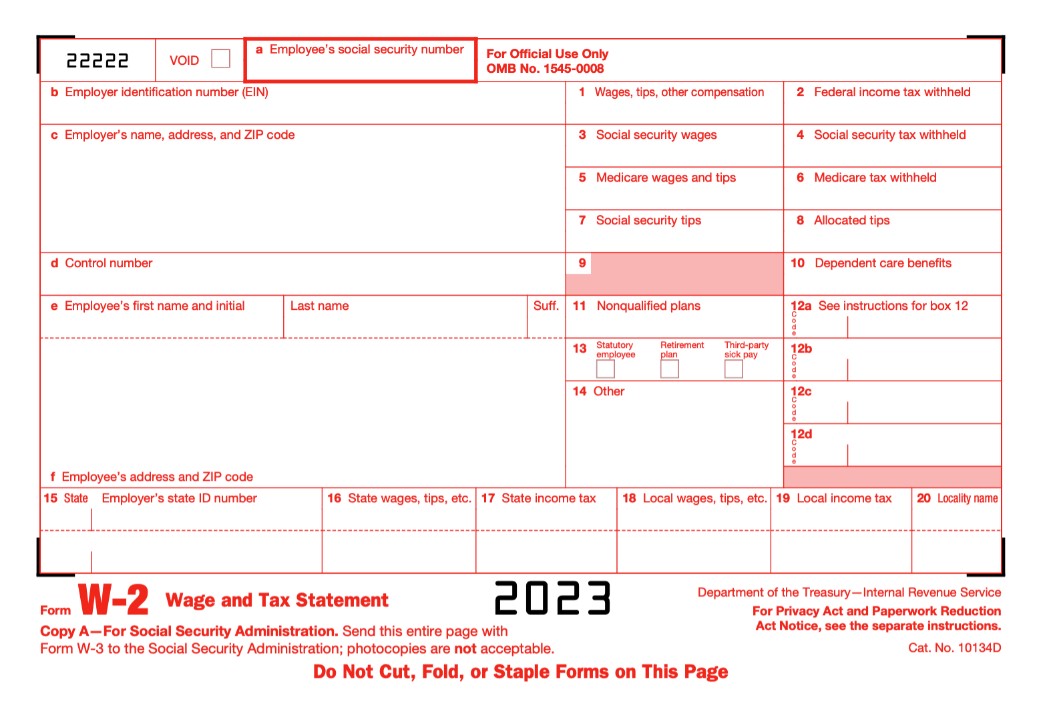

How to file Form W-2 electronically for the 2023 tax year?

Form W-2 electronic filing is accurate and secure with our software. Follow the simple W-2 instructions for easy filing of W-2 Forms.

Step 1

Create an account for Form W-2

Step 3

Once everything is done. Transmit the W-2 Form to the SSA.

When is the Deadline to File Form W-2 for

2023 tax year?

The deadline for filing Form W-2 is January 31 of every year. This deadline is for both paper filers and e-filers.

Note: If your due date for filing Form W2 falls on any legal holiday or on weekend, you need to file on the next business day.

Visit https://www.taxbandits.com/w2-forms/form-w2-deadline/ to know more about

W2 due date.

Late filing penalties for Form W-2?

If you failed to file W2 then there will be penalties imposed from the IRS based on the time period and size of the business. The

late filing penalties for W-2 filing have been increased for the 2023 tax year.

| Time Period | Penalties |

|---|---|

| If Form filed within 30 days | $60 /form |

| If Form filed after 30days and before August 1 | $120/ form |

| If Form file after August 1 | $310/ form |